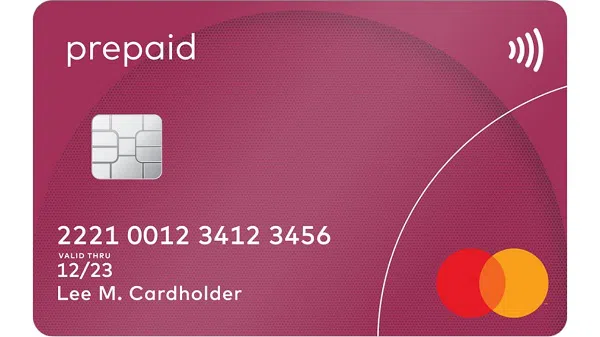

1) Key Features and Characteristics of prepaid card

A prepaid card is a payment card that allows users to load funds onto the card in advance, typically through cash deposits, bank transfers, or online transfers from a linked bank account. Once funds are loaded onto the card, users can use it to make purchases, pay bills, or withdraw cash from ATMs, like a debit or credit card. However, unlike traditional debit or credit cards, prepaid cards are not linked to a bank account or line of credit.

Here are some key features and characteristics of prepaid cards:

No Credit Check : Prepaid cards do not require a credit check or a bank account to obtain. They are available to individuals who may not qualify for traditional banking products or who prefer not to link their spending directly to a bank account.

Control and Budgeting : Prepaid cards offer users a way to control their spending and budget more effectively. Since users can only spend the amount loaded onto the card, they cannot overspend or incur overdraft fees.

Security : Prepaid cards are often seen as more secure than carrying cash, as they can be replaced if lost or stolen. Many prepaid cards also offer fraud protection features like debit and credit cards.

Acceptance : Prepaid cards are widely accepted at most merchants that accept debit or credit cards, including online retailers, restaurants, and stores.

Reloadable and Non-Reloadable : Prepaid cards can be either reloadable or non-reloadable. Reloadable cards allow users to add funds to the card multiple times, while non-reloadable cards are typically used for one-time purchases and cannot be reloaded.

Fees : Prepaid cards may come with various fees, including activation fees, monthly maintenance fees, transaction fees, ATM withdrawal fees, and balance inquiry fees. Users should carefully review the fee structure associated with a prepaid card before choosing one.

Limited Features : While prepaid cards offer convenience and flexibility, they may have limitations compared to traditional debit or credit cards. For example, they may not offer rewards programs, cashback benefits, or overdraft protection.

Overall, prepaid cards can be a useful financial tool for individuals who want to manage their spending, avoid debt, or have limited access to traditional banking services. However, it's important for users to understand the terms, fees, and features of prepaid cards to make informed decisions about their use.

2) How to Reload Money on a Prepaid Card

Reloading money onto a prepaid card can typically be done through several methods, depending on the specific card issuer and their policies. Here are some common ways to reload money onto a prepaid card:

Direct Deposit : Many prepaid card issuers offer the option for users to set up direct deposit with their employer or government benefits provider. This means that funds are automatically loaded onto the prepaid card whenever a paycheck or benefits payment is received.

Bank Transfer : Users can transfer money from their bank account to their prepaid card online or through their bank's mobile app. This usually involves adding the prepaid card as a payee or recipient and initiating a transfer of funds.

Cash Reload Networks : Many prepaid cards are affiliated with cash reload networks which allow users to add cash to their prepaid card at participating retailers, convenience stores, or financial service centers. Users typically provide the cash along with their prepaid card to the cashier, who then loads the funds onto the card electronically.

Online Transfer : Some prepaid card issuers allow users to transfer funds from another prepaid card or online payment account to their prepaid card through an online portal or mobile app.

Mobile Check Deposit : Some prepaid card issuers offer mobile check deposit features that allow users to deposit checks into their prepaid card account by taking a photo of the check with their smartphone.

Bank Teller Deposit : Users may be able to deposit cash or checks into their prepaid card account by visiting a bank branch and speaking with a teller.

Reload Packs or Vouchers : Some prepaid cards offer reload packs or vouchers that users can purchase at retailers and redeem online to add funds to their prepaid card account.

It's important for users to be aware of any fees associated with reloading money onto their prepaid card, as some methods may incur fees depending on the card issuer and the reloading method used. Additionally, users should ensure that they follow the specific instructions provided by their prepaid card issuer for reloading funds to avoid any potential issues or delays.

Services

Merchant & Partner (Online)

Disclaimer: This service is provided on an “as is” and “as available” basis. RelamPay disclaims all liability and makes no express or implied representation or warranties of any kind in relation to the service including but not limited to: an availability, an accessibility, time lines, and uninterrupted use of the service; and sequence, accuracy, completeness, timeliness or the security of any data or information provided to you as part of the service. For more details and definitions, please refer to terms and conditions.